north carolina estate tax id

Intellectual Property NASAA - North American Securities Administrators. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State.

A Guide To North Carolina Inheritance Laws

Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable income from North Carolina sources or income which was for the benefit of a North Carolina resident and the estate is required to file a federal tax return for.

. An addition is also required for the amount of state local or foreign income tax deducted on the federal return. North Carolina Secretary of State Business Registration Get a Federal and State Tax Id Number. If your business or organization fits any of the below characteristics you will need a North Carolina Tax ID EIN.

They will be updating pictures for the appraisal card. 2 South Salisbury St. If you want to establish a credit history for your business you will need an EIN.

The grant project funded by the US Environmental. Our property records tool can return a variety of information about your property that affect your property tax. Operate a North Carolina Corporation or Partnership.

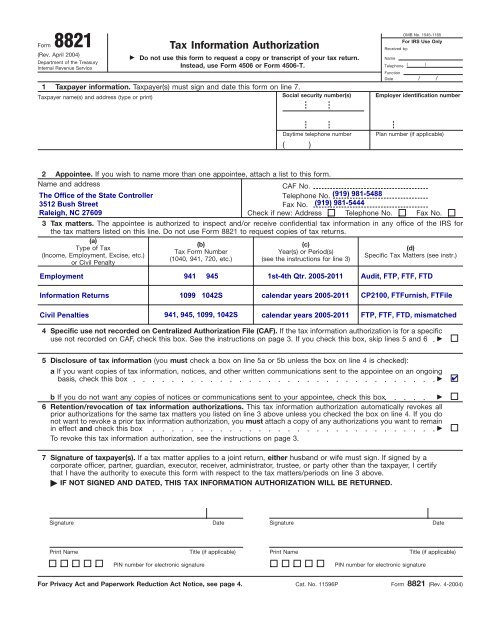

A valid North Carolina driver license or ID issued after. File Tax Returns for Employment Excise or Alcohol Tabacco and Firearms. Search Catawba County property tax assessment records by address owner name subdivision parcel id or book and page number including GIS maps.

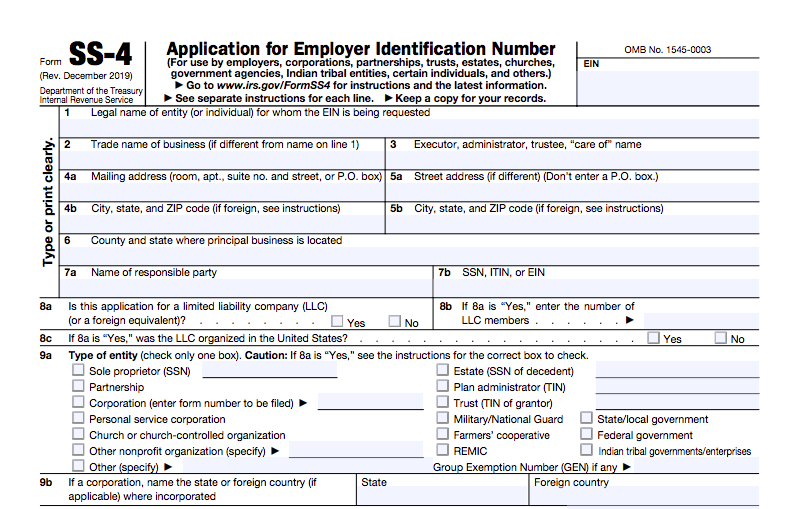

An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X. The 2004 General Assembly amended GS. It is a number issued to a business by the Internal Revenue Service IRS and not the State of North Carolina.

By mail to Orange County Tax Office PO Box 8181 Hillsborough NC 27278. Catawba County Tax Department. Muntjac deer for sale near singapore craft organisation crossword clue 5 letters north carolina estate tax id.

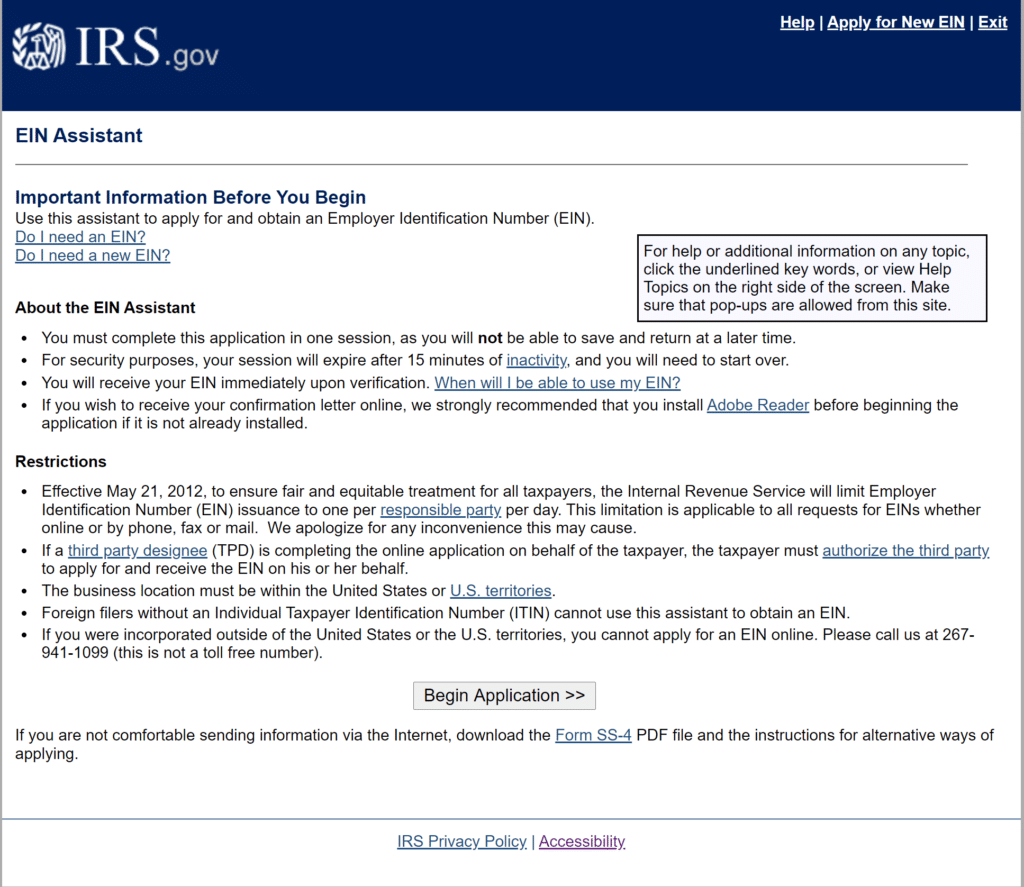

Before filing Form 1041 you will need to obtain a tax ID number for the estate. Online by Card or E-Check go to Public Web Access. 1301 Mail Service Center Raleigh NC 27699-1301.

An EIN is an acronym that stands for Employer Identification Number. PO Box 25000 Raleigh NC 27640-0640. Popular Searches on ncsosgov.

A tax ID number in NC is similar to an EIN. We have placed a new secure outdoor drop box beside the mailboxes in the Judge E. Box 125 Camden NC 27921.

The State of North Carolina developed an online tool for integrating land ownership from county sources. DROP BOX located outside our office door at the Gateway Center 228 South Churton Street Hillsborough. Other entities also use EINs.

Individual income tax refund inquiries. Download our FREE eBook guide to learn how with the help of walking aids like canes walkers or rollators you have the opportunity to regain some of your independence and enjoy life again. Operate as Trust Estate or Non-Profit Organization.

An EIN is also called a Federal Tax ID number or Tax ID number TIN. North Carolina Secretary of State. Maurice Braswell Cumberland County Courthouse back parking lot off Cool Spring and Russell Streets.

Think of a TIN exactly like a social security number. A tax ID number in NC is similar to an EIN. Posted On March 31 2021 at 250 am by tiempo barcelona aemet.

Therefore the North Carolina estate tax is equal to the 2001 state death tax credit for estates of decedents dying before July 1 2005. Pay online with your credit card or bank account. Division Contacts Phone Numbers.

Property Tax Collections Past Due Taxes Business Registration Information for Tax Professionals. PO Box 25000 Raleigh NC 27640-0640. Contact Johnston County Government PO.

Individual income tax refund inquiries. Have W-9 Employees in North Carolina. Yes Estates are required to obtain a Tax ID.

Use our free North Carolina property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms. North Carolina Department of Revenue.

WHNSGray News A man in North Carolina decided to mix things up when he bought his most recent lottery ticketYamir Bryant almost went. How can we make this page better for you. 100-A SW Boulevard Newton NC 28658.

Search sosncgov Search Text. Phone payments by Card 919-583-6137 a convenience fee is charged by a third party. Property Tax Collections Past Due Taxes Business Registration Information for Tax Professionals.

Menu NC SOS Search. Tax Assessor and Delinquent Taxes. Pay tax bills.

Open a North. Uncategorized north carolina estate tax id. State Property for Sale Property Search.

If there are any concerns please do not hesitate to contact Lisa Anderson Tax Administrator at 252 338-1919 ext. North Carolina Department of Revenue. The NC Parcels Transformer translates parcel data from all 100 counties and the Eastern Band of Cherokee Indians into a data set with standard data fields for display and analysis across county boundaries.

North Carolina Secretary of State Business Registration Get a Federal and State Tax Id Number. Therefore the North Carolina estate tax is equal to the 2001 state death tax credit for estates of decedents dying before July 1 2005. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration.

North Carolina Department of Administration. For example it is used as the estate of a deceased individual tax ID. Camden County Tax Department PO.

North carolina estate tax id. The decedent and their estate are separate taxable entities. They will have ID and magnetic signs on the car.

105-322b to provide that the North Carolina estate tax is calculated without regard to the deduction for state death taxes allowed under section 2058 of the Code. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same additions and deductions.

A Guide To North Carolina Inheritance Laws

Understanding The Employer Identification Number Ein Lookup

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

How To Start A Photography Business In North Carolina Lifestyle Portrait Photography

Irs Form 8821 Tax Information Authorization North Carolina Office

Discover A Bunch Of Interesting Facts About North Carolina It Is The 11th Largest State In The U S In Gdp

Legal Elite Business North Carolina

How To Get A Business License In North Carolina Truic

A Greensboro City Park Tops A Toxic Landfill North Carolina Health News

How To Get An Ein For A North Carolina Llc Step By Step Llc University

A Guide To North Carolina Inheritance Laws

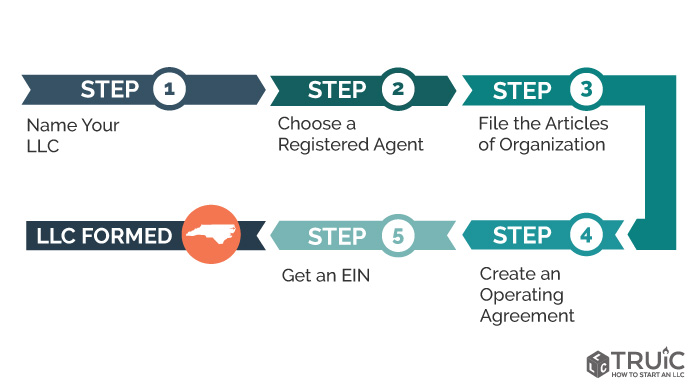

How To Set Up A Real Estate Llc In North Carolina Truic

How To Set Up A Real Estate Llc In North Carolina Truic

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

North Carolina Sales Tax Small Business Guide Truic