unemployment tax break refund update today

The IRS announced earlier this month that the agency had begun the process of adjusting tax. Tax filing season had been open for about a month when the relief bill was signed into law.

State Income Tax Returns And Unemployment Compensation

IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes.

. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. This means you cannot be taxed on the money you got in. 22 2022 Published 742 am.

Millions of Americans are due money if they received unemployment benefits last year and. If both spouses lost work in 2020 a married. IRS to begin issuing refunds this week on 10200 unemployment benefits.

But that doesnt mean the couple as a tax unit always gets tax waived on double the amount. And this tax break only applies to 2020. The IRS said Friday it has since identified 10 million taxpayers who had already filed their returns by.

Only up to the first 10200 of unemployment compensation is not taxable for an individual. Dont expect a refund for unemployment benefits. The IRS has sent 87 million unemployment compensation refunds so far.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The federal tax code counts jobless. The new rules stipulate that unemployment benefit money is not earned income during the coronavirus pandemic.

By Anuradha Garg. Each spouse is entitled to exclude up to 10200 of benefits from federal tax. If you received unemployment benefits and have not filed your 2020 tax return yet the IRS has worked with tax preparation software companies to reflect the updates for those.

The total amount of the unemployment tax break refund is 10200. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

With less than a week to go before the official end of summer many patient Americans are still wondering if theyll ever receive one of those. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. According to the IRS 9 million taxpayers are still waiting for their 2020 tax refund.

A total of 542000 refunds are involved Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system. IR-2021-71 March 31 2021 To. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

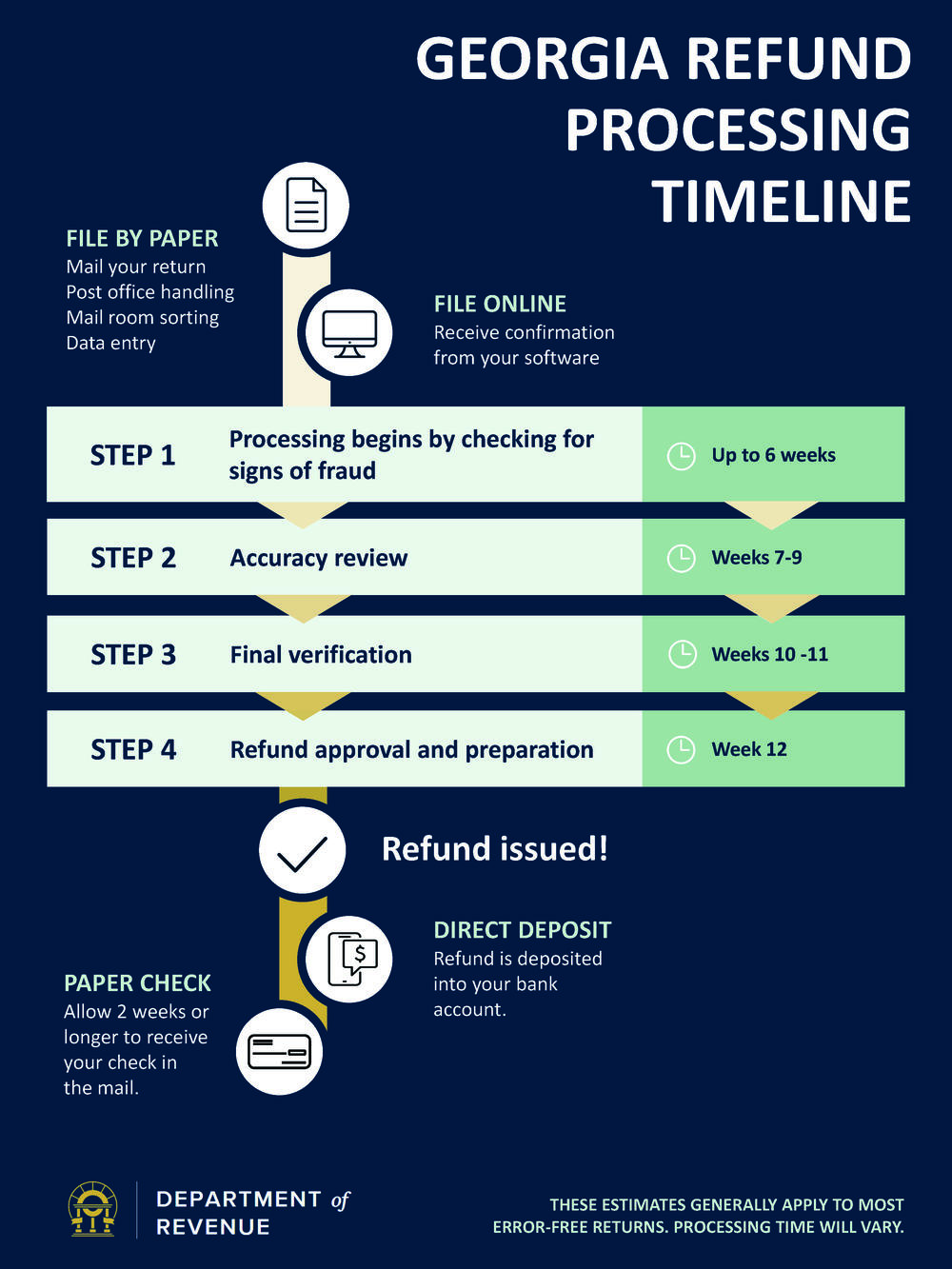

Check My Refund Status Georgia Department Of Revenue

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

What The Irs Says About That Unemployment Stimulus Tax Break The San Diego Union Tribune

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Misleading Post Links Unemployment Benefits Reduced Tax Refunds

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Guide To Unemployment Taxes H R Block

At Least 7m Americans In Line To Receive 10 200 Unemployment Tax Break Fox Business

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

1099 G Unemployment Compensation 1099g

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa